Let's make business data work for you

With data from us, you can look beyond the obvious. The world does not lack data, but insights.

We exist to give them to you.

/f/82473/3000x1688/9a65dbab2b/header.png)

/f/82473/3000x1688/9a65dbab2b/header.png)

This is why customers choose us

View all referencesAfter testing for a few months, Eika can conclude that Enin web portal will make the onboarding of new customers a lot more efficent, especially KYC processes.

Enin enables us to increase and improve the quality of our credit process, says Sindre Ljostad Trana, Senior Business Controller

The solution from Enin is a lot more user-friendly than what we have used before. We use it, amongst other things, to clean and enhance our portfolio, monitoring, examination of customers and prospects, as well as looking in to company structures.- Frode Flesjå, bank manager Corporate market in Jæren Sparebank.

The data from Enin will give my team super powers. - Christopher Conradi, Chief Digital Officer

Get the data flowing the way you prefer. Use our Web portal or Api

/f/82473/653x530/4e4ff70f6a/ownership-chart.gif)

We believe in our dataflow adapting to your workflow.

/f/82473/5472x3648/00580586b5/small-13.jpg)

Do you need advice or customization?

We can customize your experience, and help you and your employees integrate Enin into your solution.

Enjoy our “All you can eat” pricing

Learn moreTry our web portal

We exist to collate and create meaning out of

messy and fragmented data.

/f/82473/5472x3648/6daa7be420/small.jpg)

Talk to our tech team, get instant support and documentation

We know the feeling.

You just want to look through the technical documents in peace and quiet, and when you start implementing you want to ask a tech person about a specific issue and not have to go through customer service.

News

Finn prospekter i webportalen med kart

Ved å søke etter en adresse, lage en ring eller trekke linjer i det området du ønsker å prospektere i, kan du nå enkelt finne prospekter nære hverandre i webportalen til Enin.

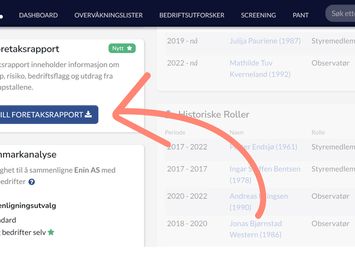

Nå er foretaksrapporter tilgjengelig i webportalen

Vi starter året med å introdusere mulighet for å dokumentere informasjonen på vår «company page» i webportalen.

Firmaattest og benchmarkrapport i Enin webportal!

Vi er opptatt av at alle våre kunder skal få mulighet til å teste nye produkter og tjenester. Denne gangen har vi tilgjengeliggjort en fast utvidelse og en testversjon av en ny analyse.

/f/82473/391x420/104e139275/eika-og-enin-1.png)

/f/82473/391x420/104e139275/eika-og-enin-1.png)

:fill(ffffff)/f/82473/480x480/f4429b4ccb/eika_barcode_intelligence.png)

:fill(ffffff)/f/82473/480x480/f4429b4ccb/eika_barcode_intelligence.png)

/f/82473/384x421/0c9dbd6f63/bn-bank.png)

/f/82473/384x421/0c9dbd6f63/bn-bank.png)

:fill(ffffff)/f/82473/508x415/c1283c9271/bnbank.jpg)

:fill(ffffff)/f/82473/508x415/c1283c9271/bnbank.jpg)

/f/82473/1676x1516/15269c07d0/image-53.png)

/f/82473/1676x1516/15269c07d0/image-53.png)

:fill(ffffff)/f/82473/654x238/cb1d47b41a/jaeren_sparebank.jpg)

:fill(ffffff)/f/82473/654x238/cb1d47b41a/jaeren_sparebank.jpg)

/f/82473/729x711/cdacc9efcb/chris-conradi-smaller.jpg)

/f/82473/729x711/cdacc9efcb/chris-conradi-smaller.jpg)

:fill(ffffff)/f/82473/300x114/d80b877b0b/fsn.png)

:fill(ffffff)/f/82473/300x114/d80b877b0b/fsn.png)

/f/82473/1597x1111/e8331d6e37/screenshot.jpg)